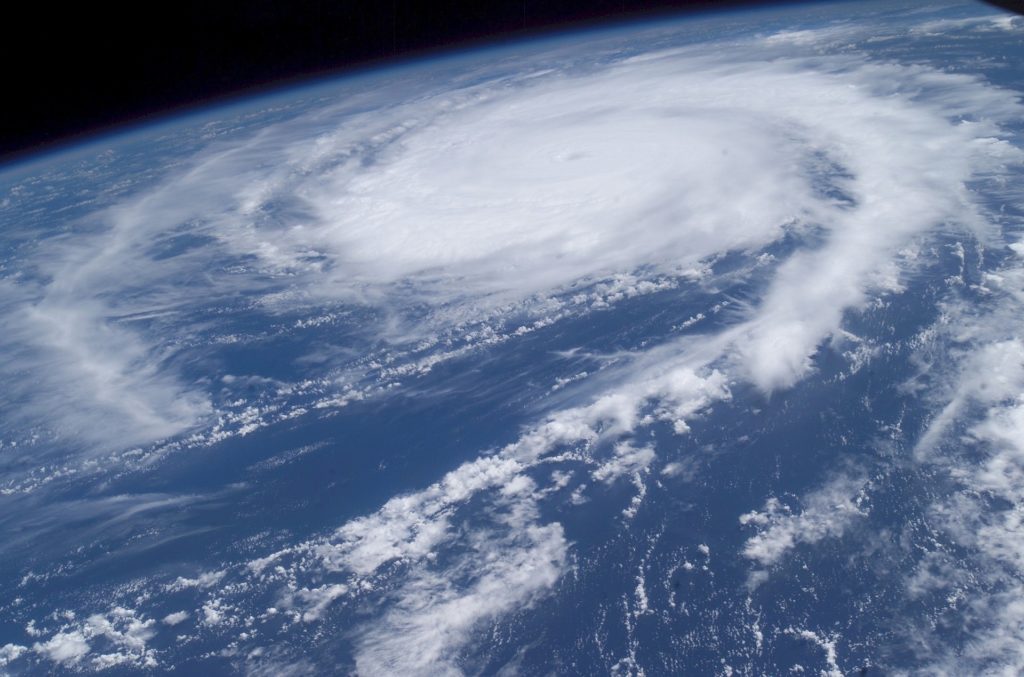

Florence Called, Florida: You Need Flood Insurance Now.

The lesson from Florence is clear: Florida residents need flood insurance, and they need it now. Waiting for that tropical system to appear on the radar is not wise; the National Flood Insurance Program usually imposes a 30-day waiting period before issuing coverage. By that time, multiple storms could loom on the horizon. If you didn’t know that a typical homeowners’ policy does not cover flooding, you do now.

Water has yet to recede in North Carolina; adjusters can’t push through the dreaded surge to evaluate the extent of the damage. Flood insurance coverage is not the norm in the affected area, so even cautious damage estimates are in the low billions. The Associated Press reports that a mere 35% of properties located in ‘flood hazard areas’ were insured when Florence hit.

Florida does not have to face the same level of devastation after such a storm. Here’s how to find a flood policy that’s right for you:

- If you don’t currently have flood insurance, contact an insurance advisor to learn about options. This professional will discuss with you the differences between private flood insurance and flood insurance obtained through the National Flood Insurance Program.

- Consider going private. The same waiting period does not usually apply in the private marketplace, and this avenue offers additional benefits.

Contact your W3 Insurance advisor today and cross ‘obtain Florida flood insurance’ off your To Do list. We’ve witnessed the devastation from Florence in the beautiful state of North Carolina. Let us all in the Sunshine State be prepared if such a storm turns our way.