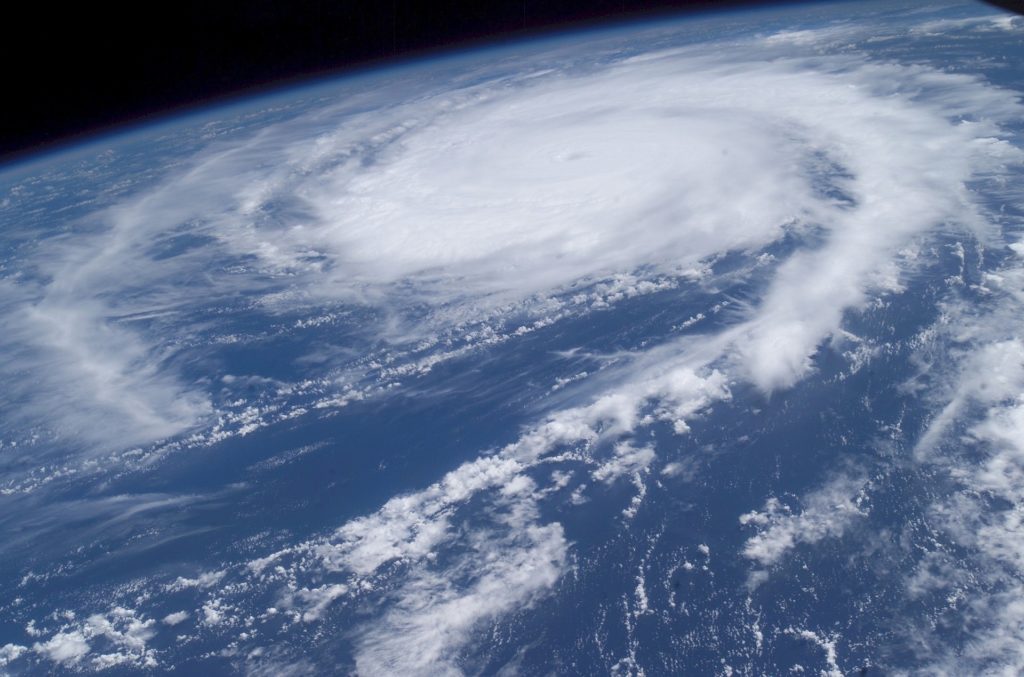

Top Hurricane Claims of 2017: Learn From the Past and Prepare for the Future

Florida boat owners: This blog contains the most valuable advice you’ll read before the 2018 hurricane season begins. Learn from the top hurricane claims of 2017. Protect your marine investment. And should history repeat itself and massive storms fill the forecast, know that you and your vessel are secure.

According to Insurance Journal, hurricane claims were so high in 2017 that many major insurers issued profit loss warnings. For boat owners, this means plenty of damages were filed. There is a silver lining in this news. Irma and Harvey taught us all a valuable lesson: We must pay attention to the scope and depth of our marine coverage. Boat owners, your marine insurance policy is a vital element of your storm preparedness plan.

Here are the top hurricane claims of 2017 and what you should learn from them:

Physical Damage Coverage

Have you elected physical damage coverage, also known as hull coverage? If not, put it as number one on your hurricane preparedness priority list.

Beware, boat owners who elect liability coverage only. High winds and flying debris from storms caused major damage to boats in 2017. If you opt to not purchase hull coverage, you may end up paying more to repair your vessel. Additionally, you will not have recompense for salvage expenses. This leads us to the next large hurricane claim category.

Salvage Claims After a Hurricane

Vessels submerged due to storm surge have to be recovered somehow, and many boat owners made a costly mistake in 2017. Though some followed the protocol outlined by their individual marine policies, others hastily signed contracts with marine salvage companies as soon as the storm dissipated. It’s understandable that they were eager to recover their boats as soon as possible, but this is a costly mistake.

Salvage service is expensive, and providers need to be approved by your insurance carrier. If salvage services are necessary and time permits, check first with your insurer.

Hurricane Haul-Out Coverage

Many policies allow for some reimbursement if you have your boat moved by professionals or haul out your vessel at a marina facility. This is called ‘hurricane haul-out protection,’ and it usually reimburses the insured 50% of expenses up to a specified limit. Hurricane haul-out coverage customarily goes into effect if NOAA issues a hurricane watch or warning for the location where the boat is being stored.

Avoid the need for salvage altogether by accessing this benefit – and prepare that vessel for future inclement weather.

Named Storm Deductible

Another great way to prepare for hurricane season is to check your named storm deductible (NSD). Many marine policies contain up to a 10% NSD derived from the vessel’s agreed value. Some even offer partial reimbursement if you implement a hurricane haul out plan to mitigate vessel damage. That proactivity means there will be no need for a hull damage claim – and you will save a significant amount of money.

Hurricanes and Marine Insurance Claims

The two major takeaways from the 2017 Florida marine insurance claims list are to purchase adequate insurance and have a means to secure your vessel. Make a hurricane plan now for your vessel- and follow through with it. A Florida marine insurance agent with access to a variety of markets is the best advisor as you prepare for the 2018 hurricane season.

We all hope that this year is quiet compared to the 2017 maelstrom. Florida boat owners should be prepared just in case.