What Do 1095 Forms Mean to Your Business?

The 1095 forms are a brand new tax form implemented in 2016 that your employees will need to file their taxes. This form goes hand in hand with the Affordable Care Act (ACA) and its requirement to carry health insurance. The 1095 provides the IRS with information needed to validate whether employees and employers have satisfied the requirements of the ACA. It is considered your “Proof of Insurance”.

The 1095 forms are a brand new tax form implemented in 2016 that your employees will need to file their taxes. This form goes hand in hand with the Affordable Care Act (ACA) and its requirement to carry health insurance. The 1095 provides the IRS with information needed to validate whether employees and employers have satisfied the requirements of the ACA. It is considered your “Proof of Insurance”.

There are three different versions of 1095 that you need to be aware of:

- 1095-A: This is a form that is provided to all individuals who purchased coverage through the ACA marketplace.

- 1095-B: This version is the form filed and mailed by the insurance carrier. All insurance carriers are required to send this form to their insureds.

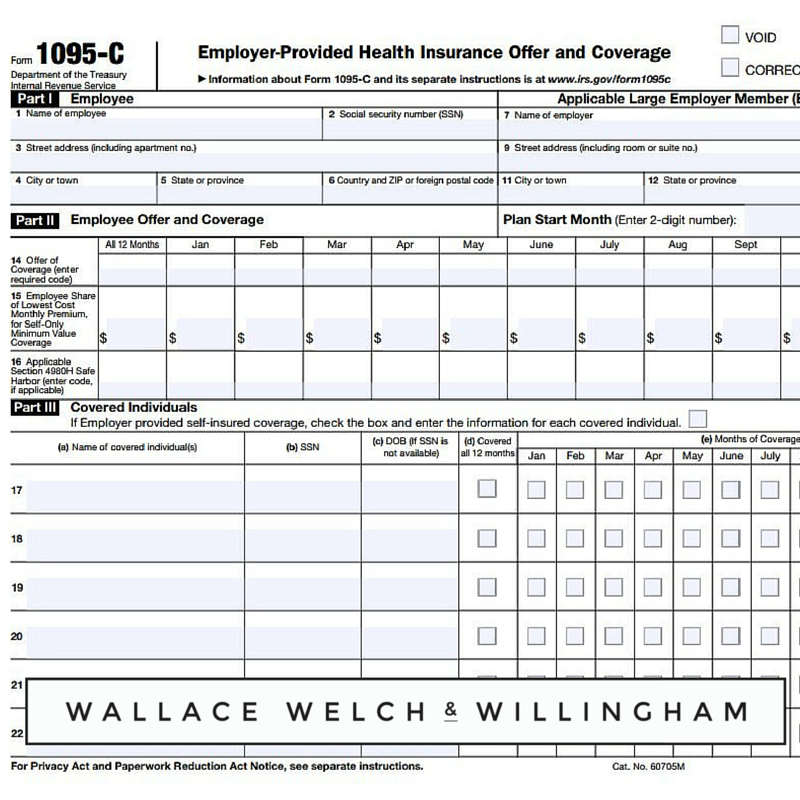

- 1095-C: This 1095-C is the form that all employers with 50 or more employees need to complete and send to all of their employees that had health insurance coverage in 2015.

So what does this mean to me as an employer?

Well, that depends…

Do you have OVER 50 full-time employees?

- You are required to send the 1095-C form out to all your employees.

- Your employees will be receiving, AT LEAST, two 1095 forms. More if they have been at additional employers in 2015. They need to know what these forms are and that they need to keep them for their taxes. So if your employee had two different jobs in 2015, he or she would likely get FOUR separate 1095 forms. They are going to want to know what these are for and more importantly – to not throw these away! Download an employee communication regarding the 1095-C form

- Employers are also required to file form 1094, which is the summary transmittal form. It is just like the W-3 you send along with your W-2s.

Do you have UNDER 50 full-time employees?

- You are not required to send a 1095-C form, but must be able to explain to your employees what the 1095-B form is and why they are receiving it.

- It is in your best interest to communicate with your employees that they should not throw these forms away. Download an employee communication regarding the 1095-B form

How to Complete These Forms (OVER 50 Full-Time Employees)

By now, your benefits broker should have discussed what options you have regarding the completion of these forms. Many HRIS, payroll and Benefits Administration vendors have added modules that can be used to assist with this task. W3 also worked with our technology consultant to create a self-service tool much like “Turbo tax” that can be used to walk you through completion step by step.

What is your Deadline?

These deadlines where recently extended to give employers and other providers more time to analyze and report coverage information.

- March 31, 2016 – Deadline for furnishing Forms 1095-B and 1095-C to individuals

- May 31, 2016 – Deadline for filing Forms 1094-B, 1095-B, 1094-C and 1095-C with the IRS

- June 30, 2016 – Deadline for electronically filing Forms 1094-B, 1095-B, 1094-C and 1095-C

Good to know…

Due to the delay of the ACA reporting deadlines, some individuals may not receive Form 1095-C by the time they file their income tax returns.

For 2015 only, individuals who rely on this information from their employers to determine whether or not they are eligible for premium tax credits do not need to amend their tax returns once they receive Form 1095-C.

Instead, they should keep this form for their tax records. This exception also applies to individuals who may rely on Form 1095-B to prove they had minimum essential coverage all year.