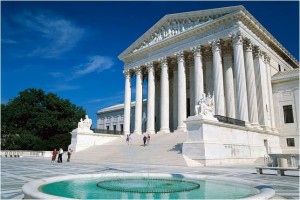

Now that the Supreme Court has ruled… what’s next?

The individual mandate will stand as a “tax” versus commerce and Affordable Care Act will move ahead. With all the fanfare Employers are beginning to plan for their next steps.

The individual mandate will stand as a “tax” versus commerce and Affordable Care Act will move ahead. With all the fanfare Employers are beginning to plan for their next steps.

Some next steps Employers need to be thinking about:

1). Review your benefit offerings to make sure they meet the guidelines of essential coverage.

2). Watch your mail for notice of the MLR rebate and determine how you will distribute if your

plan qualifies.

3). Confirm with your carrier that your plan has been amended to comply with the Women’s Preventive Care provisions. Must comply as plans renew beginning 8/1/12.

4.) Be on the lookout for your new Summary of Benefits and Coverage. Carriers are required to provide these for open enrollments/plan years beginning 9/23/12.

5.) If you have a Flexible Spending Account (FSA) you will need to check the allowable maximum. It is now restricted to $2,500 per person up to $5,000 per family.

6.) Employers who submit 250 or more W2 for 2012 must include the value of health care coverage in box 12 on employees W2. Check with your payroll vendor to make sure this amount can be tracked and reported.

Looking further ahead 2014 marks the deadline for many of the major provisions in Obama Care. Individual mandates begin, wellness initiatives are strengthened, automatic enrollment is mandated, waiting periods are restricted, penalties for NOT providing coverage begin, exchanges roll out, pre-existing provisions are eliminated and premium subsidies for lower income individuals become available.

Wallace Welch and Willingham is monitoring the events as they unfold and will keep you up to date on steps towards compliance. We welcome your questions and will be happy to assist.

This legislation still has many voids and unanswered issues. We anticipate seeing significant clarification and revision. The 2012 presidential election could also have significant impact on the Affordable Care Act. So, for some employers “wait and see” may still be the best next step.